Leviticus 25:3-5 Six years you shall sow your field, and six years you shall prune your vineyard, and gather its fruit; 4 but in the seventh year there shall be a sabbath of solemn rest for the land, a sabbath to the Lord. You shall neither sow your field nor prune your vineyard. 5 What grows of its own accord of your harvest you shall not reap, nor gather the grapes of your untended vine, for it is a year of rest for the land.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

We are familiar with the concept of the Sabbath day. It was a very strict Old Testament command; the 7th day was to be a day of rest with no work or business activities performed. Which is interesting is that God also applied this rule to the land itself. The Israelites were commanded to only plant and harvest their crops six out of seven years. The seventh year the land was to simply lie fallow. This was a very difficult command to follow, as it meant one whole year with no income to the farmer. This would be the equivalent effect to a year in which locusts ate up the harvest. Purposefully avoiding a year of harvest seemed unreasonable and would have taken great faith to fulfill. It is clear from scripture that the Israelites never actually took this command very seriously, but kept planting year after year with no rest.

Of course, today with modern agricultural science, we know the importance of giving the land its rest. After several years of intensive farming, the land uses up most of its nutrients. A year of rest is necessary to allow the ground to replenish itself, preparing it for greater future productivity. Phosphorus and potassium rise toward the surface of the soil, while carbon and nitrogen levels also increase. In addition, the fallow year also breaks the pest and disease cycle. With modern day pesticides we often forget how disease could ravage a person’s crops. The coordinated sabbath year would remove the hosts for all of these parasites and diseases which would ravage the crops.

During the 1930’s, Oklahoma and surrounding states experienced the “dust bowl” drought, leading to crop failures and a mass-exodus of millions from the region which is told in story form in the famous novel “The Grapes of Wrath.” This was one of the greatest times of suffering in American history, only topped by the Civil War. Topsoil was ripped out of the ground by massive winds, creating clouds which blackened the skies and often lowered a person’s visibility to only a few feet in front of them. One of the major causes of this disaster was due to intensive farming practices which did not respect the soil. Crops were never rotated to give the ground a rest. Certain crops are very intensive, while others are beneficial to the soil. Sometimes a farmer gets greedy and tries to plant the higher-profit intensive crop year after year, but this always catches up with them. One of the government’s solutions to the drought was to promote strip-farming. This method has a long strips planted with the main crops, while alternating strips either lie fallow or have a low-intensity cover crop which allows the ground to recover, the same basic principle of giving the land its rest.

The massive prairie winds could have been stopped by leaving the trees on the edges of the field, as is done today. The Bible states the periphery of the field was not to be harvested, but rather left for the common people to enjoy.

Leviticus 23:22 “‘When you reap the harvest of your land, moreover, you shall not reap to the very edges of your field nor gather the gleaning of your harvest; you are to leave them for the needy and the stranger. I am the LORD your God.’””

Deuteronomy 20:19 “When thou shalt besiege a city a long time, in making war against it to take it, thou shalt not destroy the trees thereof by forcing an axe against them: for thou mayest eat of them, and thou shalt not cut them down (for the tree of the field is man's life) to employ them in the siege”

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

In these two verses we see the general idea. The boundary was not to be harvested and trees were not to be cut down when possible. Rather than plant to the ultimate edge, knowing they could not harvest that section anyways, the farmer was likely to leave trees there, which would also happen to function as a windbreak. Going back to this biblical principle allowed the dust bowl to reverse so that the prarie states could once again be productive farmland. It all came from adhering to the biblical principles, learning that sometimes less is more and that we shouldn’t overwork everything to its marginal limit. Proverbs 13:23 states “Much food is in the fallow ground of the poor.” The idea being that letting the ground at the margin rest and lie fallow, will actually result in a higher overall productivity. We think the food comes from the harvest, but there is also food in the fallow ground.

Giving our land its rest

What modern day lessons can we learn from the Sabbath year? One is to avoid greedy short-term thinking. This is the lesson of “killing the golden goose,” the saying derives from one of Aesop’s fables. For those who are unfamiliar with this story, a farmer is given a goose which lays a golden egg each day. He assumes there must be a huge amount of gold inside the goose and kills it in order to have all of the gold at once. By doing this, the farmer loses out on the endless income he could have had, due to his desire to experience a temporary larger amount. This is what can happen when we strain our productive resources to their limit. Productivity will be increased in the present, but for the long-term it is impaired by burnout.

Sometimes we waste time chasing mediocre opportunities instead of waiting for the best ones. Thus although ending up putting in greater effort, it actually results in lower profit. As an example, suppose you see a few of your friends or contacts start their own business. We see a lot of success and “inspirational” stories about so-called “self-made” individuals. You may feel the tug of jealously, and want to be called a “businessman” or “entrepreneur” and thus begin to investigate. There may not have been a particularly compelling opportunity at the time, but due to wanting to appear successful, you strain to try to find one. This opportunity is likely to be subpar with unfavourable risk-reward versus if you had waited patiently and watched for a more striking opportunity. On the other hand, suppose a person is disciplined against greed and impatience. This individual can wait for the right moment and only pursue the business venture which is highly compelling, rather than just trying to start a restaurant or whatever the first thing is which comes to mind. Many of the Market Wizards in the books series of the same name, mention the importance of being extremely selective in investment choices and waiting on the sidelines when nothing is appealing. It takes a lot of patience to do, but is a critical concept to practice.

Numerous times I have missed out on great trading opportunities due to being fully invested and having no spare cash set aside. I came to realize how the principle of fallow land applies. For an active trader or investor, having 20% of your stock account in cash can be a great idea. This will allow you to trade events and opportunities which come up and are too good to miss. Being 100% invested in stocks can caused missed opportunities because you become emotionally attached to your stocks and do not want to sell them to free up buying power for the opportune trade. Also it takes a couple days after selling in order for the cash to settle before you make another trade. This can result in missed opportunities while you wait for settlement and the chance may be gone. Having 10-20% cash also help protect against stock market declines, and allows you to buy more at a lower price if your stocks fall with a market turn.

There are times in which no great investment opportunities appear in a given “field.” For instance, after having an incredible winning streak through 2020, the new year rolled around and everything in my field (growth stocks and SPACs) appeared to be high-priced and overvalued; there were no good deals to buy. Despite the market being so overvalued, I mentally brushed aside the thoughts of wisdom which were to sell and move to cash. I stayed invested and the market had a massive selloff for the next three months. Looking back, there were two wise options either of which would have provided success. The first one is crop rotation (sector rotation). I could have sold the expensive growth stocks and invested in another field such as crypto, commodities, or value stocks. The second option was to let the land lie fallow (move to cash). Either of these options would have provided great success, versus succumbing to greed and staying invested in a field I knew was mostly depleted.

In 1969, famous investor Warren Buffet (the “Oracle of Omaha”) closed his fund and returned all the fund’s money to investors. This was not due to any lack of performance or interest. Rather, he simply told investors that he could not longer find any good opportunities as all stocks had become overvalued. Buffet had discovered the fallow principle. Investments then entered a huge bear market for the next decade and only returned to breakeven after 18 years. By moving to cash (fallow) rather than crops (stocks), Buffet was able to save his investors from disastrous losses. We need to learn to think with this same mindset. When all the good opportunities have dried up, it may be a season to shift to fallow and reduce risk.

Sabbath year cycle, the Shmita

Now I want to give a shoutout to my friend Dedric Hubbard for discovering the link between the stock market returns and Shmita years. After looking these years up versus a long term S&P 500 chart, I could indeed verify that the correlation in very true and accurate. The Sabbath year, the Shmita, was not only an ancient practice but it a modern concept tracked by today’s Jews. Every seventh year is a Shmita, including the upcoming Jewish new year which begins September 7, 2021 and ends in fall of 2022. It is a little different from our Gregorian calendar which begins in January, since the Jewish calendar always begins around September. So we will be shortly entering the Sabbath year. I actually had no clue of this while first writing this up, but it shows me that this is a timely message. Now the interesting this is that these years often correspond to recessions and major stock market crashes. The stock market decline often either happens throughout the year, or immediately following the year’s completion:

Sabbath years and stocks

Counted from September to September, approximately tracking the Jewish new year

1965-66 Stocks decline around 10%

1972-73 Major decline, stocks lose 40% of their value

1979-80 Stocks kept going up this time

1986-87 “Black Monday” Oct 19, 1987, worst 1-day stock market decline of all time

1993-94 Market broke its uptrend and went flat

2000-01 Dotcom bubble bursts, initiating multi-year bear market

2007-08 Major financial crisis leading up to “great recession”

2014-15 Market broke its uptrend and traded sideways

2021-22 ???

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

As can be seen, the Sabbath years (and months immediately before and after those years) tend to be very unlucky for stocks and investing overall. Of these eight years we have looked at, the market continued upwards in only one of those years! (1979-80)

Stock market advice

[Disclaimer: I am not a financial advisor and this section is for informational purposes only]

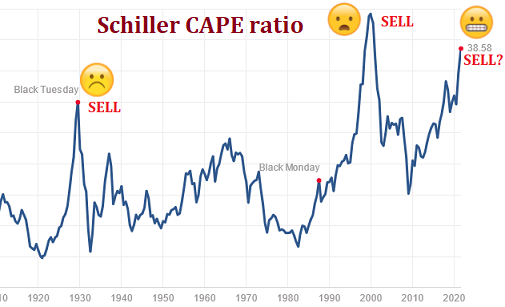

Everyone seems to think that since the market had a correction in 2020 due to covid, that somehow means we are “safe” from having another one for many years. Nothing could be further from the truth. The stock market is greatly overvalued at the present time. In March 2000, Robert Schiller released his book Irrational Exuberance, (which is a great book by the way) predicting the painful end of the stock market bubble. His timing was excellent as his book's release was the exact month stocks topped before going into a multi-year bear market. Mr. Schiller created an indicator known as the CAPE which describes whether stocks are too expensive or are undervalued bargains. The average is 17. The current number is 39. The maximum ever recorded was 44 during the dotcom bubble. What does this mean? It means there is not much upside, but major downside. Stocks in general are likely to give little to no returns in the decade ahead. People are trusting in getting a 10% annual return for retirement. This will be almost impossible to achieve by with index or mutual funds.

Everyone seems to think that since the market had a correction in 2020 due to covid, that somehow means we are “safe” from having another one for many years. Nothing could be further from the truth. The stock market is greatly overvalued at the present time. In March 2000, Robert Schiller released his book Irrational Exuberance, (which is a great book by the way) predicting the painful end of the stock market bubble. His timing was excellent as his book's release was the exact month stocks topped before going into a multi-year bear market. Mr. Schiller created an indicator known as the CAPE which describes whether stocks are too expensive or are undervalued bargains. The average is 17. The current number is 39. The maximum ever recorded was 44 during the dotcom bubble. What does this mean? It means there is not much upside, but major downside. Stocks in general are likely to give little to no returns in the decade ahead. People are trusting in getting a 10% annual return for retirement. This will be almost impossible to achieve by with index or mutual funds.

Mutual funds have been celebrated as a way in which investors can diversify among many stocks while having a “professional” manager pick stocks for them. There are huge problems with this model. The first is that these managers are unable to beat the market, nor do they even attempt to do so. A 2020 report studying a 15-year period showed that 90% of mutual fund managers could not even outperform their passive index benchmark. They are being paid huge fees out of your profits in order to deliver inferior returns. Often a mutual fund’s “management fee” is 2% annually. This may seem like a small number, and yet it is actually a massive cut. If your profits are 8% per year and they take 2%, that leaves you with only 6%. That means their true fee was 25% of your profits! They also collect their fee regardless of how well or poorly they perform. If their benchmark index achieved 10% gain and they achieved only 8%, they will still collect the same fee from you. In this case you are basically paying them for the privilege of getting subpar returns. With this incentive structure, it is no wonder these managers do not even try to win. Another problem is that in academia there are many false teachings about how the stock market works. One is called the “efficient market hypothesis.” This belief is that a stock is never under or overvalued but that its price always matches its true value. This is such a laughable concept and no real trader takes it seriously. Looking throughout history the market is always having irrational bubbles and crashes and stock prices veer off very far from the company’s true value. Nonetheless, this theory is always taught in academia and most mutual fund managers believe in it as well. Obviously if they believe it is impossible to outperform the overall market, they are not even going to attempt to do so. So the question then arises, why pay these people anything at all? It is all a giant scam in my opinion.

The S&P 500 in my view, has also become somewhat of a bubble due to the concept of “passive indexing.” In the recent decades, countless books have preached that nothing can beat investing in an S&P500 index fund. This has resulted in a steady deluge of funds invested in these instruments. This results in those 500 stocks being greatly overvalued compared to other stocks which were not included in the index. Even if the market does not correct, overall returns in these stocks are almost guaranteed to be very subpar going forward.

What should you do? For most people, it takes far too much time and effort to learn to choose good stocks. Therefore, I would recommend you pay for a premium subscription to a reputable stock-picking service and then choosing your stocks out of their list. The price will be small in comparison to the performance gain versus the mediocre mutual funds. Many “free” stock articles are low-quality and their authors are simply trying to fulfill a daily quota. Many of them spend less than 1hr researching the stock they discuss in the ‘free’ article. Paid services are much higher quality. One of the best value paid services is Motley Fool Stock Advisor. There are also premium services on Investorplace, Zacks, and others. Some of the services they sell will be overpriced, but they usually offer at least one or two that are fairly cheap ($100 or less per year). If you really don’t want to pay and would rather do everything yourself, then I recommend you find people from the top 2% ranked analysts on Tipranks and follow their articles on their sites and ignoring everyone else lower on the list. There is a tremendous difference in quality between the top and the mediocre analysts. Often the mediocre analysts will try to impress you with endless charts and graphs on their articles, but their picks steadily go down. They will be full of confidence and make their picks sound like they are the “sure thing,” and yet their track record is subpar. Only follow top-rated authors and analysts. But again for most people I recommend paying for a premium service, rather than trying to figure the game out yourself.

One strategy that could work great this upcoming year is that used by Nassim Taleb, named the “barbell.” This is to leave 80% of funds in ultra-safe things like cash or certificates of deposit and then use the other 20% on high-risk high-reward things like small-cap hypergrowth stocks. Most supposedly “safe” stocks will decline anyways during a market crash or bear market. Thus there is really no such thing as a “safe” stock. It is better to look for the greatest speculative stocks which have the potential to grow their earnings very fast while being priced at fair value. In his excellent book The Black Swan, Taleb divided the safe/risky % as 90/10 each person has to decide what applies to their own situation. A young person should take more risk. This is a year when it is a good idea to have extra cash ready and not to be fully invested or using margin. It is a great idea to sell off stock indexes at the current time when they are overpriced like this. Go to a mix of holding plenty of cash with some speculative stocks for the upcoming year; don’t be fully invested in normal stocks or indexes at this time until their valuations come down.

Year 2022

I have been anticipating this new year for some time. The number 22 is the most powerful of all numbers in numerology. It relates to the apostle and architect.

As the greatest apostle, Paul worked as a master builder. 22 is the number of the apostolic. This is because in the Hebrew alphabet there are 22 letters which are the “building blocks” to form the language of God’ word. Furthermore, in the human body there are 22 amino acids which are the “building blocks” which all proteins are constructed out of. We can therefore see the relationship between 22 and constructing something out of its elemental components. In Isaiah 22:22 it says “The key of the house of David I will lay on his shoulder; So he shall open, and no one shall shut; And he shall shut, and no one shall open.” The apostle only appeared in the New Testament. In the Old Testament, you had prophets and kings which were as close to the apostolic as you could get. The apostolic unites the functions of king and prophet into one person, thus being a weighty calling to bear.

Let’s us examine some characteristics of 11 and its counterpart 22.

11 is the number of the prophetic; 22 relates to the apostolic.

11 is the number that represents darkness; 22 signifies light.

11 is the feminine; 22 the masculine.

11 is parallel; 22 is the cross (perpendicular)

1 Corinthians 3:10, “According to the grace of God which was given to me, as a wise MASTER BUILDER I have laid the foundation”

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

This is a year to be breaking generational curses by stepping out in faith. Do an honest evaluation of the struggles in your family lineage. Some people may have had a family of scoffers and will have generational spirits of pride and doubt. Others may have a workaholic lineage which worshiped “hard work” as an end in itself, trusting in the brute force of hard work rather than in wisdom. After prayer and making a thorough list of all recurring generational struggles, next go to God, repent of them and ask for deliverance. After you have done this, look for ways to act in the exact opposite way of the generational curse. Also be constantly speaking positive affirmations in line with the deliverance and not words of doubt and bondage. Each positive act and word is like a brick you are laying to build the foundation of a new life. Lay a new one each day and they will add up like compound interest. Finally, ask God what you can do to step out in radical faith next year, removing all limitations. This is “turning the key.” 22 is the number of the “Key of David” which is mentioned in Isaiah 22:22. The faith is having the key and the action is to turn the key. So this year will be absolutely critical in opening those locked doors. People will come across once in a lifetime opportunities and this is your only chance to open the door and escape from the bondage. Really grab the bull by the horns and get started now in preparing for this powerful new year. This is not a time to hide and procrastinate. Ask God to expose to you how you have been limiting Him in your mind in all areas of life and tell Him that you want to go all the way into His next level for you. “The Lord hates the coward” is going to be the key slogan of this year.

Hebrews 10:38

“Now the just shall live by faith;

But if anyone draws back,

My soul has no pleasure in him.”

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Number 22 symbolizes ‘light.’ As a result, God is not looking for anyone who wants to hide. Go after the open doors and opportunities with your whole heart. Do not hide yourself back from what God is leading and prompting you forward into. God is looking for people walking toward the light, not those who draw back into the comfort of obscurity. Don’t limit what you ask from God, believe Him for, and take action towards.